Tax consultant for AGs (stock corporations): Legally sound tax structuring for large companies

- Use tax structuring to reduce your tax burden to 1.5% and less

- We take account of corporate law, trade law, inheritance law and other aspects

- Legally sound tax concepts for AGs (stock corporations) with profit of EUR 500,000 and more

Thomas Breit

- Expert for tax optimization

- Experience with 3,500 mandates

- Tax consultant since 2006

Our services as tax consultants for AGs (German stock corporations)

Optimize the tax burden on an AG disposal

Thanks to our expertise, we can help you pay no more than 1.5% tax on disposal of an AG.

Minimize taxes on profits (for a period of 7 years)

With our advice the tax rate on profits will be reduced to a mere 1.5% for the next 7 years.

Minimize taxes on profits (for an unlimited period of time)

We can help you achieve a tax rate of only 14% on stock corporation profits on a permanent basis. This low tax rate will apply indefinitely.

Reducing taxes on profit distribution

Instead of the usual income tax rate (e.g. 46% or even the maximum rate of 48%), we can help you lower the taxes on profit distributions from your stock corporation to just 1.5%.

We do not offer the following services

No routine accounting services

Our tax consultancy services for stock corporations concentrate on tax structuring measures and advice in connection with ownership structures. Our focus does not lie on preparing the classical accounting documents or carrying out payroll accounting.

As experts for tax optimization, we see ourselves as creative designers providing you with strategic advice on how to set up your stock corporation so as to ensure your tax burden is as low as possible.

We do not provide answers to individual unrelated tax issues

Our tax consultancy for stock corporations does not extend to individual tax issues that are not part of a larger project. Instead we focus on developing comprehensive tax concepts and advise you on how to find long-term solutions.

No companies with profit of less than EUR 500,000

Furthermore, we do not provide our services to stock corporations with profit of less than EUR 500,000. Our specialized services are aimed at companies that have reached a certain size and have specific requirements in the fields of taxes and succession planning.

How can you benefit from our tax consultancy services for AGs?

Our tax consultancy for stock corporations focuses especially on asset building, family wealth planning as well as inheritance and succession planning. Our aim is to develop strategies that are tailored exactly to your needs and, ideally, will also save you thousands of euros in taxes.

Thorough consideration of various legal fields

Our concepts go beyond the consideration of tax law. I also incorporate aspects of corporate law, trade law, inheritance law, family law, law of obligations and other relevant fields of legal practice into my concepts. This universal approach allows me to carry out holistic and legally sound tax structuring and tax planning on your company’s behalf.

Legally sound and sustainable solutions

We attach great importance to developing legally watertight and sustainable concepts. A written and legally binding statement from the tax authorities obtained by us will provide you with the certainty you need. This way we minimize potential risks and can guarantee that your tax matters are dealt with in a legally sound and sustainable way.

Access to sophisticated solutions beyond the standard approach

We, as a specialized consultancy firm, pride ourselves on being able to offer our clients much more than the usual standard solutions. One example is setting up a German Kommanditgesellschaft auf Aktien (KGaA – partnership limited by shares). This particular legal structure opens up a wide variety of advantages and structuring options that are often overseen by other tax consultants.

Tax consultant for AGs (stock corporations): Case study

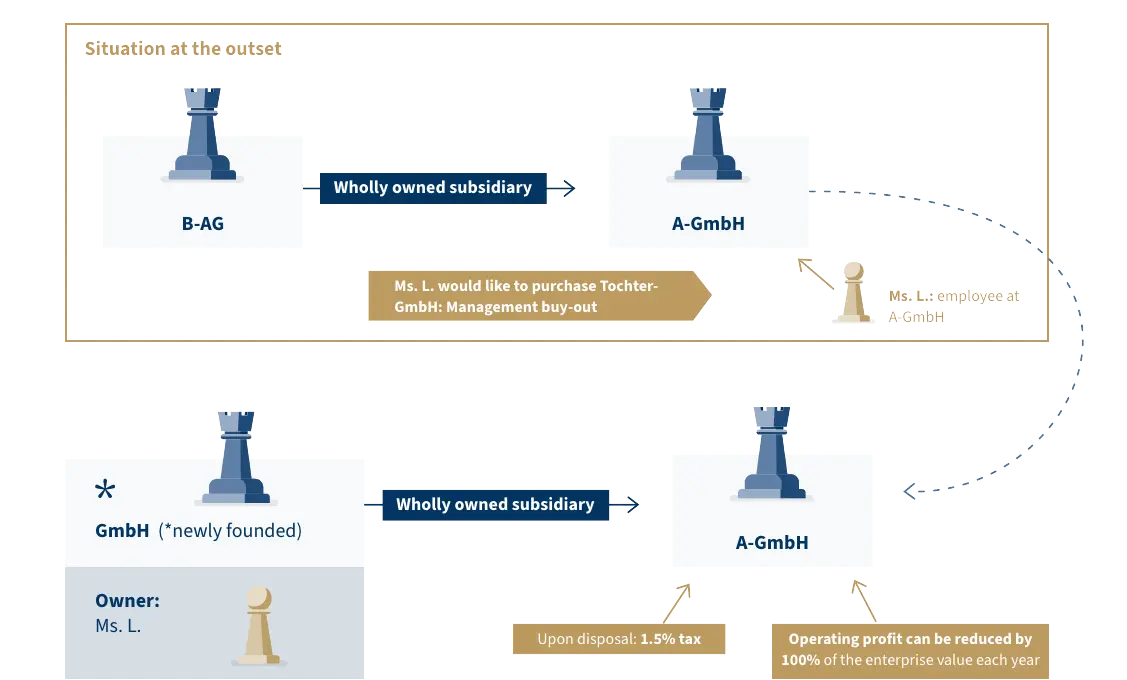

Situation at the outset

B-AG has a subsidiary that takes the form of a limited liability company (A-GmbH). Ms. L., a senior executive of this subsidiary wanted to acquire A-GmbH by means of a management buy-out.

In a direct private sale to Ms. L. it would have been impossible to write off the enterprise value in its entirely, thus substantially affecting the creditworthiness. Furthermore, in the case of a resale of the GmbH, Ms. L. would have faced a very high tax burden.

How did we solve the issue?

Rather than selling the subsidiary directly to Ms. L., Ms. L. set up a new GmbH that acquired the operating subsidiary. By setting up a new parent company in the form of a corporation, it was possible to write off the entire enterprise value and carry out the sale at the minimal tax rate of 1.5%.

In addition, this structure also solved an additional problem: The subsidiary generated a profit, whereas the parent GmbH served merely to write off the enterprise value which could, however, not be offset. Therefore the profits were subject to ongoing tax payments. In order to avoid the subsidiary having to pay taxes on the profits, the companies concluded an agency agreement (Geschäftsbesorgungsvertrag). This way the operating profit could be reduced by the impairment of the enterprise value every year.

We deliberately chose not to recommend concluding a profit and loss transfer agreement as this would have led to a five-year tie between the parent company and the subsidiary, rendering a potential disposal problematic. With an agency agreement, a disposal can be carried out at any time.

What advantages does this have?

A disposal can take place at any time at the minimal tax rate of 1.5%.

With the help of the agency agreement, the profits of the subsidiary could be reduced by offsetting the entire impairments on the enterprise value.

Common questions regarding Thomas Breit Tax Services

What does the consultation cost?

My consulting services are billed by the hour (Thomas Breit: EUR 580 net/hour, employee: EUR 380 net/hour). The analysis and your objectives will determine which concept is the best fit for your needs. The total cost of implementing this chosen concept will depend on the actual amount of time needed for the implementation. An advance of EUR 20,000 plus statutory VAT is payable when the order is placed (equivalent to the minimum fee). This advance is enough to finance the smallest project. A cost-benefit analysis always comes before concept and implementation.

My fees are generally financed by the tax savings you achieve. The return on investment is between six months and no more than two years.

Additional costs may be incurred for court fees, notary costs and an expert for corporate law, depending on the project.

Can I work together with my own lawyer/notary?

We can of course work together with your usual partners. Should you need experts, we have a good network of corporate law experts and notaries.

Do I have to transfer my entire mandate to Thomas Breit Tax Services?

No, we only work on a project basis. We do not offer any financial or payroll accounting as we are highly specialized. In some cases, however, it makes sense for us to prepare your annual financial statements incl. tax returns for the years around the restructuring. We will then return these tasks to your tax consultant and draw attention to the particulars.

Has there ever been a case of poor advice being given?

No, never. 3,500 cases in 23 years – no slip ups.

How long does it take to develop a concept?

Developing a concept can take between three and eighteen months, depending on the project. In rare cases, it may take as many as three years to implement a concept.

Will you answer my other tax questions?

Yes and no.We are basically able to answer any questions concerning tax law. However, many of these questions can be answered just as well by other tax consultants with lower hourly rates, which is why we recommend you retain your usual tax consultant for such questions.

Why can’t other tax consultants do what you do?

My expertise covers every legal aspect of civil law, such as private law, company law, commercial law, international tax law, inheritance law and much more. In a way, you can compare it to a general practitioner who knows about the heart but is not able to perform heart surgery. I am the cardiologist among tax consultants and my specialty lies in providing comprehensive advice that goes beyond tax law itself.