Tax consultant for gift tax: Make legally compliant arrangements for your succession during your lifetime

- Plan your succession early on & reduce tax

- Legal certainty for family members, heirs & successors

- Organize your succession according to your wishes

Thomas Breit

- Expert for tax optimization

- Experience with 3,500 mandates

- Tax consultant since 2006

Our services as tax consultants for gift tax

Find a solution by combining inheritance and gift tax law, corporate law and trade law

As a specialized tax consultancy office, we carefully plan and implement measures in line with inheritance law, while also taking into account the relevant aspects of corporate and trade law. We use all the possibilities the inheritance tax law offers in order to achieve the best tax-related outcome for our clients and keep the tax burden as low as possible.

Setting up a family holding company

We can help you design and set up a family holding company. By setting up a family holding company, assets can be transferred within the family with a minimal tax-related impact. Our expertise includes legal design and structuring of this type of company, enabling you to gift assets and reduce tax at the same time.

Making gifts without having to pay gift tax

We support our clients in planning and making gifts without having to pay gift tax. By carefully analyzing your actual situation and by using suitable structuring options under tax law, we can help our clients make arrangements for their assets, ideally without having to pay gift tax.

We do not offer the following services

Providing answers to individual unrelated tax issues

Our services as tax consultants for gift tax are aimed at larger projects where we provide our clients with comprehensive and holistic consultancy. This means we do not provide answers to individual questions that are not part of a larger project.

Order volume of less than EUR 20,000

In order to ensure that we can offer our clients high quality consultancy services, we have determined a minimum order volume of EUR 20,000. This enables to to invest the required time and resources in carrying out thorough analysis, planning and implementation of all tax affairs in connection with gift tax and inheritance law. Please understand that we cannot accept orders with a lower volume.

How can you benefit from our tax consultancy services for inheritance tax planning?

By structuring business assets and private property in an optimal way with regard to gift tax considerations, they can be transferred without triggering high inheritance and gift tax payments.

We combine inheritance law, corporate law and gift tax law to design optimal structures early on during your lifetime, thereby reducing the tax burden to a minimum.

Minimize the tax burden

Our team of experts is dedicated to reducing your gift tax burden to a minimum. With our excellent knowledge of the relevant laws and regulations we can develop effective tax strategies to optimize your tax payments.

Individual family wealth planning

We focus not only on tax issues, but also support you in developing a comprehensive family wealth plan. By combining inheritance tax aspects with inheritance and succession planning we can draw up individual and legally sound plans of action to optimally protect and pass on your assets.

Provide for your family members despite complicated family structures

If you are faced with a complex family structure, such as a patchwork family or if you have children that were born out of marriage or children from a second marriage, it is crucial to carefully plan your succession early on. In order to ensure that your assets are divided according to your wishes in such a family situation, we consider your wishes for the division of your assets while optimizing the gift tax burden that will be incurred.

Tax consultant for gift tax: Case study

Situation at the outset

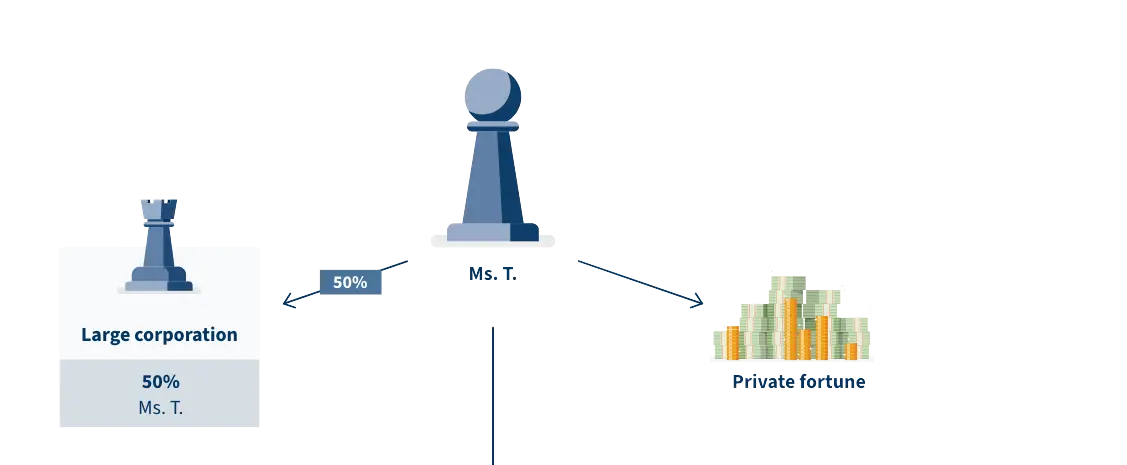

Ms. T., 70 years old, owns 50% of a large corporation with annual revenue of EUR 900 million and a profit of EUR 10 million. She has a large private fortune.

How did we solve the issue?

We developed a solution involving a family holding company to transfer her property to the son while maintaining control over the company. We set up a partnership limited by shares (KGaA) and a limited partnership with a limited liability company as the sole general partner (GmbH & Co. KG) as a subsidiary. Her son contributed obligations to the company.

What advantages does this have?

No gift tax

Succession and inheritance arrangements are settled conclusively

Common questions regarding Thomas Breit Tax Services

What does the consultation cost?

My consulting services are billed by the hour (Thomas Breit: EUR 580 net/hour, employee: EUR 380 net/hour). The analysis and your objectives will determine which concept is the best fit for your needs. The total cost of implementing this chosen concept will depend on the actual amount of time needed for the implementation. An advance of EUR 20,000 plus statutory VAT is payable when the order is placed (equivalent to the minimum fee). This advance is enough to finance the smallest project. A cost-benefit analysis always comes before concept and implementation.

My fees are generally financed by the tax savings you achieve. The return on investment is between six months and no more than two years.

Additional costs may be incurred for court fees, notary costs and an expert for corporate law, depending on the project.

Can I work together with my own lawyer/notary?

We can of course work together with your usual partners. Should you need experts, we have a good network of corporate law experts and notaries.

Do I have to transfer my entire mandate to Thomas Breit Tax Services?

No, we only work on a project basis. We do not offer any financial or payroll accounting as we are highly specialized. In some cases, however, it makes sense for us to prepare your annual financial statements incl. tax returns for the years around the restructuring. We will then return these tasks to your tax consultant and draw attention to the particulars.

Has there ever been a case of poor advice being given?

No, never. 3,500 cases in 23 years – no slip ups.

How long does it take to develop a concept?

Developing a concept can take between three and eighteen months, depending on the project. In rare cases, it may take as many as three years to implement a concept.

Will you answer my other tax questions?

Yes and no.We are basically able to answer any questions concerning tax law. However, many of these questions can be answered just as well by other tax consultants with lower hourly rates, which is why we recommend you retain your usual tax consultant for such questions.

Why can’t other tax consultants do what you do?

My expertise covers every legal aspect of civil law, such as private law, company law, commercial law, international tax law, inheritance law and much more. In a way, you can compare it to a general practitioner who knows about the heart but is not able to perform heart surgery. I am the cardiologist among tax consultants and my specialty lies in providing comprehensive advice that goes beyond tax law itself.