Tax consultant for real estate: Tax-optimization of your real estate assets

- For companies and private persons with a real estate portfolio of at least EUR 10 million

- Legally sound and sustainable tax and succession planning

- Reduce your tax burden and avoid paying high amounts to the tax authorities

Thomas Breit

- Expert for tax optimization

- Experience with 3,500 mandates

- Tax consultant since 2006

Our services as tax consultants for real estate

Tax-optimized holding structure for real estate

By creating a holding/subsidiary relationship with different legal personalities we can achieve a tax rate of 14% on reinvested or distributed profits on your behalf. These concepts offer effective tax optimization for real estate owners, whether the real estate is owned by a company or private person.

Exemption from real estate transfer tax through company transformation or the so-called intra-group transaction clause (Konzernklausel)

Paying real estate transfer tax can often be avoided by optimal tax structuring and planning measures. Possible options include using the intra-group transaction clause or company transformation.

Flexible application to various legal structures

Our tax concepts are suitable for both natural persons and co-ownerships, companies, commercial companies or corporations. We help our clients find solutions and strategies that fit their legal framework conditions.

We do not offer the following services

We do not provide answers to individual unrelated tax issues

Our tax consultancy specializes in project work, which is why we do not offer advice for individual tax questions in connection with real estate that are not part of a large project. We rather strive to work with our clients over many years to develop long-term tax strategies and tax structuring plans.

Real estate assets below EUR 10 million

We concentrate on advising clients with larger real estate portfolios owned by either companies or private persons. We recommend persons with a real estate portfolio below this threshold to contact another tax consultant who is better suited to meeting your specific needs.

How can you benefit from our tax consultancy services for real estate?

Owners of large real estate portfolios often face highly complex tax issues, especially when it comes to transferring these assets.

Our specialized services as a tax consultancy office for large real estate portfolios can help you master these tax-related issues.

Minimize the tax burden

Our knowledge of the tax regime and optimization options in the field of real estate will effectively reduce your tax burden. We develop customized tax strategies that lead to substantial tax savings.

Tax structuring for international real estate portfolios

Having provided tax advice for large real estate portfolios for more than 20 years, we have gained invaluable experience in international tax consultancy as well as tax structuring for German portfolios. We specialize in cross-border situations and are used to working across borders in multiple countries, which makes us your ideal partner in all tax issues surrounding international real estate investments.

Expert network

We provide our clients access to additional expertise and resources that go beyond pure tax consultancy. When required, we can introduce you to specialized lawyers, notaries or other experts to ensure that you receive comprehensive advice that covers all relevant aspects.

Tax consultant for real estate: Case study

Situation at the outset

Mr. E. is a physician with a monthly net salary of EUR 4,200. He also owns 86 properties in Germany and 13 in Dubai, which together generate EUR 30,000 per month in rental income. Furthermore, he earns EUR 10,000 per month from mining activities.

How did we solve the issue?

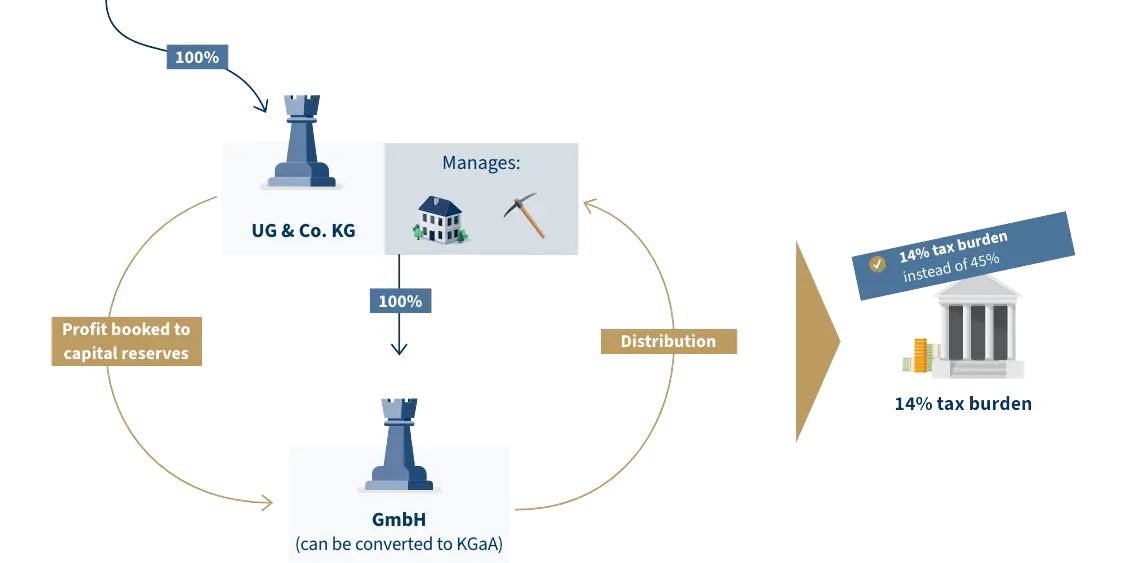

Mr. E. founded a UG & Co. KG company which he is the sole owner of. This company manages his real estate and the mining activities. He also founded a subsidiary as a GmbH.

In order to reduce the tax burden, the profit generated from the real estate properties and mining are transferred to the subsidiary as capital reserves. The GmbH then distributes the capital reserves to the UG & Co. KG.

What is the objective?

The main objective is to reduce his high tax payments of 45%.

This structure has the following advantage

Common questions regarding Thomas Breit Tax Services

What does the consultation cost?

My consulting services are billed by the hour (Thomas Breit: EUR 580 net/hour, employee: EUR 380 net/hour). The analysis and your objectives will determine which concept is the best fit for your needs. The total cost of implementing this chosen concept will depend on the actual amount of time needed for the implementation. An advance of EUR 20,000 plus statutory VAT is payable when the order is placed (equivalent to the minimum fee). This advance is enough to finance the smallest project. A cost-benefit analysis always comes before concept and implementation.

My fees are generally financed by the tax savings you achieve. The return on investment is between six months and no more than two years.

Additional costs may be incurred for court fees, notary costs and an expert for corporate law, depending on the project.

Can I work together with my own lawyer/notary?

We can of course work together with your usual partners. Should you need experts, we have a good network of corporate law experts and notaries.

Do I have to transfer my entire mandate to Thomas Breit Tax Services?

No, we only work on a project basis. We do not offer any financial or payroll accounting as we are highly specialized. In some cases, however, it makes sense for us to prepare your annual financial statements incl. tax returns for the years around the restructuring. We will then return these tasks to your tax consultant and draw attention to the particulars.

Has there ever been a case of poor advice being given?

No, never. 3,500 cases in 23 years – no slip ups.

How long does it take to develop a concept?

Developing a concept can take between three and eighteen months, depending on the project. In rare cases, it may take as many as three years to implement a concept.

Will you answer my other tax questions?

Yes and no.We are basically able to answer any questions concerning tax law. However, many of these questions can be answered just as well by other tax consultants with lower hourly rates, which is why we recommend you retain your usual tax consultant for such questions.

Why can’t other tax consultants do what you do?

My expertise covers every legal aspect of civil law, such as private law, company law, commercial law, international tax law, inheritance law and much more. In a way, you can compare it to a general practitioner who knows about the heart but is not able to perform heart surgery. I am the cardiologist among tax consultants and my specialty lies in providing comprehensive advice that goes beyond tax law itself.