Tax consultant for European tax law: Your partner for legally sound tax planning

- Use tax structuring to reduce your tax burden to 1.5% and less

- Expert knowledge on legally sound tax structuring across Europe

- We are proficient in English

Thomas Breit

- Expert for tax optimization

- Experience with 3,500 mandates

- Tax consultant since 2006

Our services as tax consultants for European tax law

Reduce your tax burden to 1.5% and less

Our main objective is to reduce our clients’ tax burden to a rate of 1.5% or even less. We achieve this tax reduction solely by applying European tax law without having to revert to dubious tax havens abroad.

Compliance with international rules

We comply with the requirements of the Organisation for Economic Co-operation and Development (OECD), the Amsterdam tax law congress (ATAR) and the German Fiscal Code (AO) Sections 138 et seq. to ensure that your tax matters are dealt with in accordance with the current legal provisions.

Setting up efficient corporate structures

We support you in setting up and optimizing corporate structures that enable an efficient and legally sound tax strategy for your company.

Use of European company structures

We apply our knowledge of European corporate structures like the European Society (SE), the European Cooperative Society (SCE) and the European Economic Interest Grouping (EEIG) to offer you possibilities to enter into cross-border business activities and optimize your tax structure.

Establishing a Tax CMS

Since 2015 international tax law requires companies to establish a Tax Compliance Management System (CMS). We help you set up and implement a tax CMS that is designed to meet the requirements of your company to ensure that you comply with your tax duties.

We do not offer the following services

This service is not for German companies without any foreign establishment

We concentrate on providing tax consultancy services to companies with sites in different European countries. We do not offer any specific services in European tax law to German companies without any business activities outside of Germany.

Foreign companies without any tax structuring involving Germany

Our specialized consultancy services do not extend to foreign companies that have no tax-related involvement with Germany.

Providing answers to individual unrelated questions

We do not provide answers to isolated and individual tax questions. We focus on providing comprehensive tax consultancy and finding solutions to complex corporate tax issues by means of strategic structuring.

Order volume of less than EUR 20,000

Our tax consultancy services in the field of European tax law are specifically targeted at companies with a minimum order volume of EUR 20,000. From this order volume upwards, we can develop bespoke solutions and provide your company with a significant tax advantage.

How can you benefit from our tax consultancy for European tax law?

We provide the full range from tax structuring to consultancy work for foreign establishments. We specialize in consultancy work for German companies with sites across all of Europe. Our tax structuring expertise will help you to effectively optimize your tax matters and to comply with legal requirements in the various European countries.

Legally compliant tax structuring

You can trust our tax consultancy office to structure your European tax matters in compliance with the applicable laws. We are familiar with the current legislation and are well qualified to minimize any potential risks and make good use of favorable tax regulations.

Professional proficiency in English

As experts in European tax law we are also proficient in English and can effectively support you in communicating with your international business partners, ensuring that tax-related questions and agreements are communicated unequivocally. You can rely on our language skills and professional expertise to handle your affairs dependably.

Many years of experience

In more than 23 years of tax advisory services in the field of European tax law we have gathered extensive experience and know-how. We have accompanied and provided our services to a high number of companies and have gained deep insights into tax-related requirements and challenges across Europe.

Tax consultant for European tax law: Case study

Situation at the outset

Four persons from three different countries wish to start a startup.

These persons are:

- E.: German resident who moves to Sweden.

- S.: Swedish resident.

- P.: Swedish resident.

- D.: Belgian resident.

How did we solve the issue?

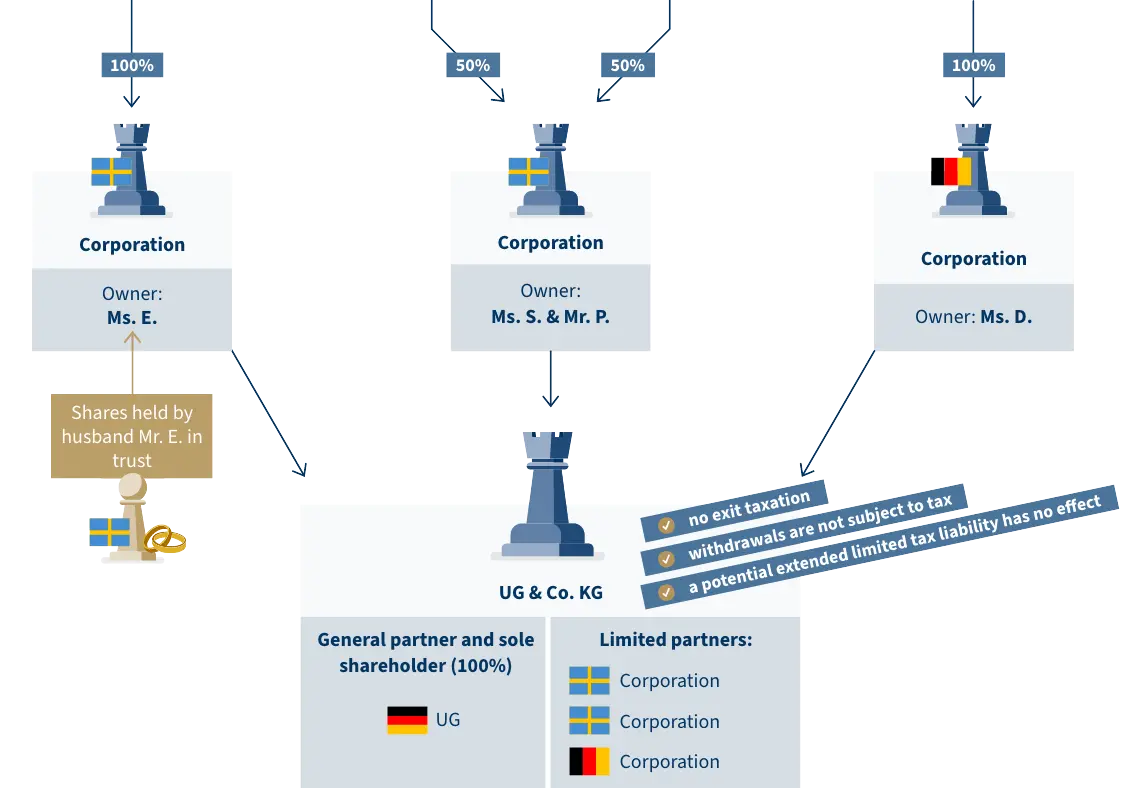

The business partners founded a UG & Co. KG (German limited partnership with an entrepreneurial company as general partner). The GmbH, which is headquartered in Germany, is the general partner and sole shareholder (100%). The GmbH is wholly owned by Ms. E.

Corporations that are set up specifically in Sweden and in Belgium are the limited partners of the UG & Co. KG. Both these corporations are wholly owned by the business partners who are resident in these countries.

What is the objective?

- To develop a legal structure for the company (German or European) that offers the best conditions – in terms of tax law and inheritance law – for the four persons from three different companies to collaborate

- and to ensure that the profits are only taxed in the respective countries.

This structure has several advantages

No exit taxation when moving abroad

Withdrawals are not subject to tax when the permanent establishment is dissolved

A potential extended limited tax liability has no effect

Common questions regarding Thomas Breit Tax Services

What does the consultation cost?

My consulting services are billed by the hour (Thomas Breit: EUR 580 net/hour, employee: EUR 380 net/hour). The analysis and your objectives will determine which concept is the best fit for your needs. The total cost of implementing this chosen concept will depend on the actual amount of time needed for the implementation. An advance of EUR 20,000 plus statutory VAT is payable when the order is placed (equivalent to the minimum fee). This advance is enough to finance the smallest project. A cost-benefit analysis always comes before concept and implementation.

My fees are generally financed by the tax savings you achieve. The return on investment is between six months and no more than two years.

Additional costs may be incurred for court fees, notary costs and an expert for corporate law, depending on the project.

Can I work together with my own lawyer/notary?

We can of course work together with your usual partners. Should you need experts, we have a good network of corporate law experts and notaries.

Do I have to transfer my entire mandate to Thomas Breit Tax Services?

No, we only work on a project basis. We do not offer any financial or payroll accounting as we are highly specialized. In some cases, however, it makes sense for us to prepare your annual financial statements incl. tax returns for the years around the restructuring. We will then return these tasks to your tax consultant and draw attention to the particulars.

Has there ever been a case of poor advice being given?

No, never. 3,500 cases in 23 years – no slip ups.

How long does it take to develop a concept?

Developing a concept can take between three and eighteen months, depending on the project. In rare cases, it may take as many as three years to implement a concept.

Will you answer my other tax questions?

Yes and no.We are basically able to answer any questions concerning tax law. However, many of these questions can be answered just as well by other tax consultants with lower hourly rates, which is why we recommend you retain your usual tax consultant for such questions.

Why can’t other tax consultants do what you do?

My expertise covers every legal aspect of civil law, such as private law, company law, commercial law, international tax law, inheritance law and much more. In a way, you can compare it to a general practitioner who knows about the heart but is not able to perform heart surgery. I am the cardiologist among tax consultants and my specialty lies in providing comprehensive advice that goes beyond tax law itself.