Tax consultant for corporations: Actual tax savings in lieu of off-the-shelf solutions

- Tax burden of 1.5% and less through tax structuring

- Avoid paying millions in taxes upon disposal or succession

- Legally compliant tax structuring concept for all types of corporations with profits in excess of EUR 500,000

Thomas Breit

- Expert for tax optimization

- Experience with 3,500 mandates

- Tax consultant since 2006

Our services as tax consultants for corporations

Tax rate of 1.5% upon disposal by setting up a family holding company

We can offer a tax-optimized solution allowing you to enjoy a tax rate of just 1.5% when selling GmbH shares, while setting up a family holding company in order to prepare for inheritance and succession.

Profits are taxed at a rate of 1.5% for the next 7 years

By including a family holding company in the overall structure, we assist companies in reducing their tax rate to a mere 1.5% over a period of 7 years. Furthermore, this approach allows for optimal tax structures in view of future inheritance or succession.

Permanent tax burden of just 14% by setting up the right structure

We develop a strategy to ensure you pay a tax rate of 14% on company profits. By incorporating a family holding company in the overall structure, we can also efficiently take account of inheritance and succession aspects.

Reduce taxes on profit distribution to 1.5% (instead of your income tax rate of up to 48%)

We support the shareholders of corporations in paying a reduced tax rate of 1.5% on profit distributions rather than their usual income tax rate.

We do not offer the following services

Routine tax consultancy services without a specific project

We focus exclusively on project work. Given our highly specialized expertise, we do not offer any services in the fields of financial or payroll accounting.

In some cases, however, it might be expedient when reorganizing your corporate structures for us to prepare the annual financial statements and the corresponding tax returns for the years in question.

Providing answers to individual unrelated questions

Our approach does not cover providing answers to individual and particular questions. We rather specialize in providing integral tax consultancy services to corporations with complex requirements and a need for strategic action.

Clients with profit of less than EUR 500,000

We concentrate primarily on corporations that are seeking to obtain all-encompassing tax structuring and planning for the next couple of years. We therefore do not offer our services to corporations with profit of less than EUR 500,000.

How can you benefit from our tax consultancy services for corporations?

As experts in tax structuring for corporations we concentrate on finding customized tax-optimizing solutions. We assist you in developing effective measures for asset accumulation, providing for your family members and designing optimal structures in preparation of inheritance and succession issues.

Legally compliant specialized solutions

Thanks to our expertise in complex tax matters we can devise highly specific concepts for different corporations. We can draw on extensive experience in legal fields such as tax law, corporate law, trade law, inheritance law, family law, the law of obligations and others. Our concepts are legally sound, sustainable and tailored to fit your personal situation.

Extensive network

In addition to our own in-house expertise we have access to an extensive network of partners and experts in adjacent fields. This gives our clients access to additional know-how and resources that go beyond pure tax consultancy. When required, we can introduce you to specialized lawyers, accountants or other experts to ensure that you receive comprehensive advice that covers all relevant aspects.

Many years of experience

Our 23 years of experience in dealing with the complex tax affairs of corporations have given us a deep understanding of the specific challenges and how to respond to them. Rather than reverting to off-the-shelf concepts, we develop a solution that brings the greatest possible benefit to you and your company.

Tax consultant for corporations: Case study

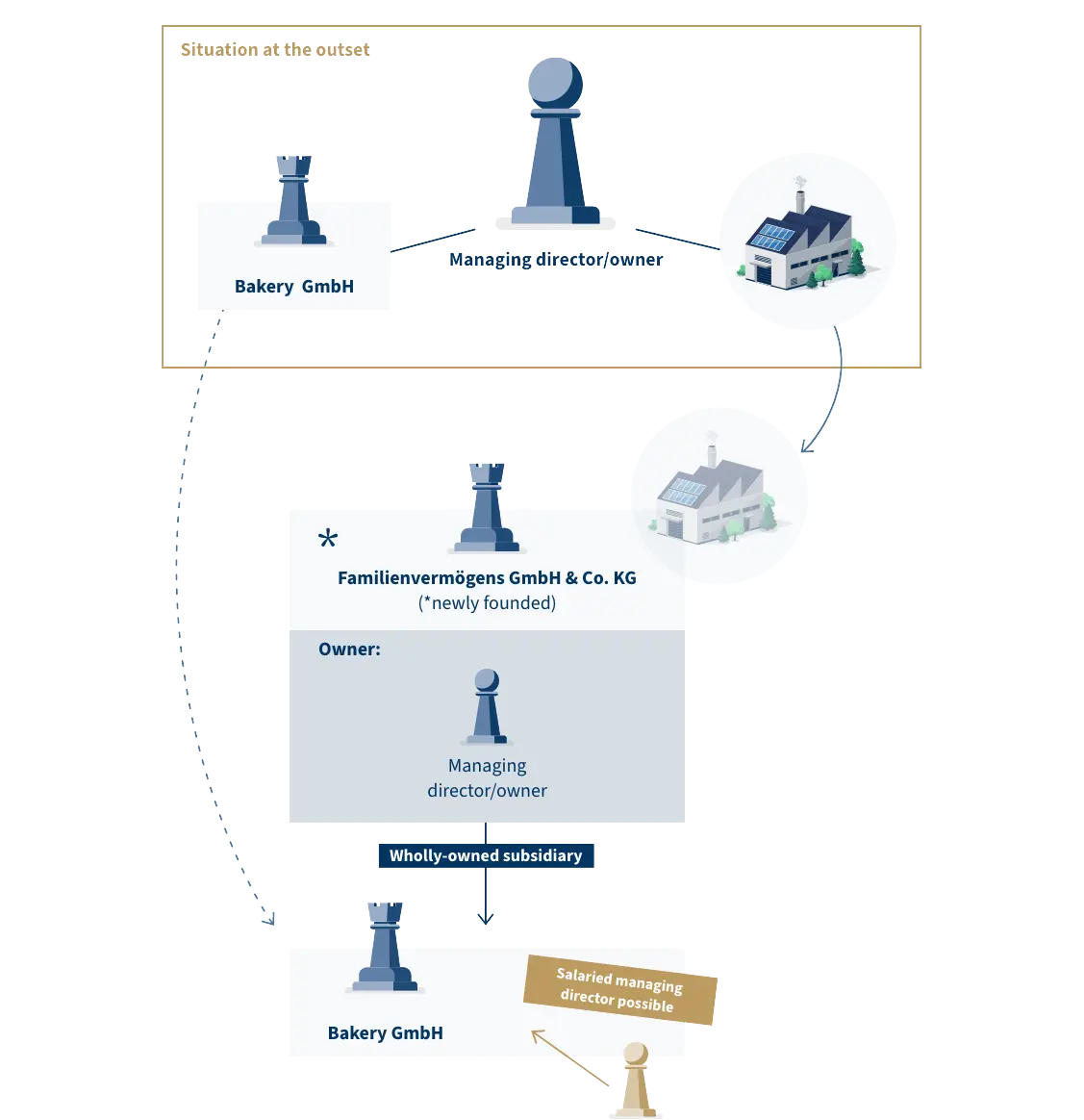

Situation at the outset

Mr. A is the managing director of a corporation, i.e. a German limited company (GmbH), and wishes to retire from the company and to hire a new managing director. The predicament is that he has several privately owned properties that are used by the GmbH and are therefore automatically included in the company’s business assets. From a tax perspective, this is a problem as the sale of the properties would entail a high tax burden.

How did we solve the issue?

In order to solve this problem, the properties were transferred to a family holding company that is structured as a GmbH & Co. KG, a German limited partnership with a limited liability company as the sole general partner. The existing GmbH was set up as a subsidiary of the family holding company, and Mr. A. became the managing director of the non-operating parent company. Thus, it was possible to hire a new managing director for the operating subsidiary without triggering the adverse tax consequences of a real estate sale.

This corporate structure ensured that the properties are still closely connected to the company and are owned by the family company. The properties were contributed to the family holding company on the basis of their carrying amounts from the 1940ies in order to avoid taxable gains. Furthermore, the properties were contributed to the GmbH & Co. KG by transferring them without consideration, thus avoiding taxable profit for the company.

What advantages does this have?

EUR 2.2 million in income tax were saved

A new managing director was hired

Common questions regarding Thomas Breit Tax Services

What does the consultation cost?

My consulting services are billed by the hour (Thomas Breit: EUR 580 net/hour, employee: EUR 380 net/hour). The analysis and your objectives will determine which concept is the best fit for your needs. The total cost of implementing this chosen concept will depend on the actual amount of time needed for the implementation. An advance of EUR 20,000 plus statutory VAT is payable when the order is placed (equivalent to the minimum fee). This advance is enough to finance the smallest project. A cost-benefit analysis always comes before concept and implementation.

My fees are generally financed by the tax savings you achieve. The return on investment is between six months and no more than two years.

Additional costs may be incurred for court fees, notary costs and an expert for corporate law, depending on the project.

Can I work together with my own lawyer/notary?

We can of course work together with your usual partners. Should you need experts, we have a good network of corporate law experts and notaries.

Do I have to transfer my entire mandate to Thomas Breit Tax Services?

No, we only work on a project basis. We do not offer any financial or payroll accounting as we are highly specialized. In some cases, however, it makes sense for us to prepare your annual financial statements incl. tax returns for the years around the restructuring. We will then return these tasks to your tax consultant and draw attention to the particulars.

Has there ever been a case of poor advice being given?

No, never. 3,500 cases in 23 years – no slip ups.

How long does it take to develop a concept?

Developing a concept can take between three and eighteen months, depending on the project. In rare cases, it may take as many as three years to implement a concept.

Will you answer my other tax questions?

Yes and no.We are basically able to answer any questions concerning tax law. However, many of these questions can be answered just as well by other tax consultants with lower hourly rates, which is why we recommend you retain your usual tax consultant for such questions.

Why can’t other tax consultants do what you do?

My expertise covers every legal aspect of civil law, such as private law, company law, commercial law, international tax law, inheritance law and much more. In a way, you can compare it to a general practitioner who knows about the heart but is not able to perform heart surgery. I am the cardiologist among tax consultants and my specialty lies in providing comprehensive advice that goes beyond tax law itself.